ACH Payments: The Ultimate Small Business Guide

Running a business often leaves business owners with little bandwidth for reflecting on backend details like how payments are processed. Usually, a business owner will outsource such concerns and focus on running their day-to-day operations. But did you know that taking a closer look at payment processing can help your business save significant amounts of money? While most businesses these days rely on credit cards and checks, ACH payments present an attractive alternative. As it turns out, they not only save you money and improve your cash flow but help with customer retention as well, especially if your business takes recurring charges.

What Is ACH (The Network Itself)?

In a world where goods move with cash, check, or credit card, you might be wondering: what is ACH?

ACH stands for Automated Clearing House. It’s an electronic network for transferring money directly between bank accounts in the United States.

The ACH payment processing network is managed by NACHA (National Automated Clearing House Association). Its responsibility is to govern, administer and manage the ACH network. NACHA has been around since 1974, and while disco and bellbottoms have gone out of style (depending on who you ask), ACH payments have not. As of 2020, NACHA facilitated more than $60 trillion in transfers, an 11% increase from 2019. With an increase in online payments, accelerated by the COVID pandemic and the rise in popularity of subscription-based services, it seems like ACH payments will see a strong increase in 2022.

As mentioned, NACHA has created the ACH network to move money and create a payment process that is independent from credit cards and more efficient than checks. What does this mean for business owners? It means cutting out payment methods like Visa or Mastercard and creating a more direct and affordable approach to moving money.

ACH payments are growing in popularity at an incredible pace. As recently as 2019, ACH transactions increased by one billion payments annually, five years in a row. Part of this growth signifies a move away from paper checks, especially vis-a-vis business payrolls and B2B transactions.

In 2020, 2 billion employee payments occurred via ACH, and there was a 15% increase in B2B transactions, which totaled $1.2 billion.

What Is an ACH Payment?

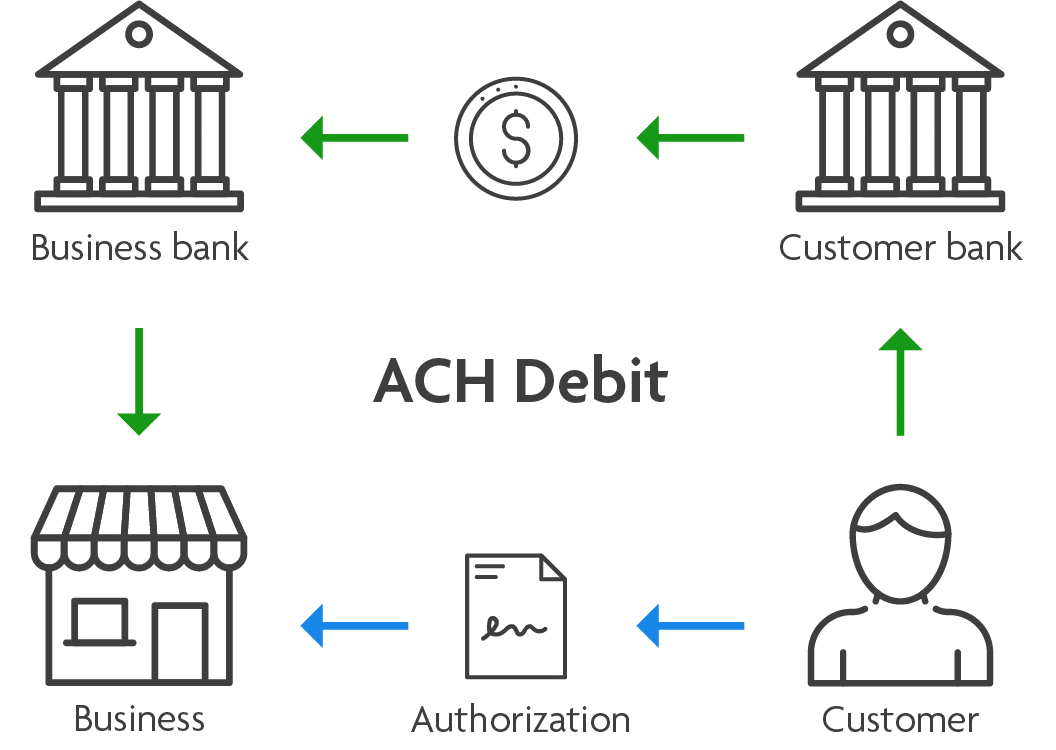

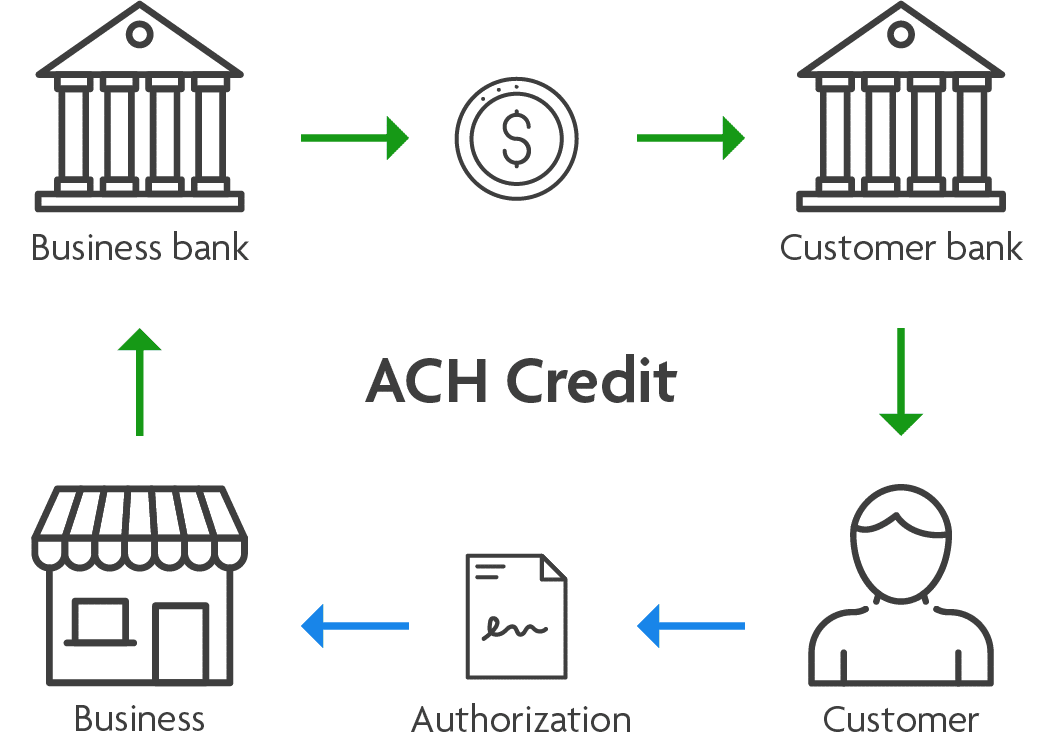

There are essentially two sides to an ACH payment: an ACH debit and an ACH credit. As you can probably guess, ACH debits involve funds being pulled out of an account (like payment from a utility bill) and ACH credits involve funds being sent from an account (like an employer sending payment to their employee).

What is an ACH Debit?

An ACH debit is a bank-to-bank electronic transfer that is initiated by the payee (your business) when the payor (your customer) gives permission to do so. Permission is obtained through an ACH authorization form to outline the agreement and to make sure both sides are on the same page. ACH debits are a great fit for businesses that have an ongoing relationship with their customer and invoice them on a regular or recurring basis.

Learn more about creating an ACH authorization form

What is an ACH Credit?

An ACH credit is an electronic money transfer initiated by the payer to another bank account. The two most common types of ACH credits are direct deposit and direct payment.

Between the two, the most common form of ACH credit is direct deposit. Perhaps the best real-life example of a direct deposit is when a business uses it for payroll. As much as 94% of the American workforce gets their “paycheck” directly deposited into their bank account. This can be far more convenient than receiving a paper check that needs to be cashed or deposited and cleared before the funds can be accessed.

A direct payment is an ACH credit that is used as payment, as an alternative to checks or credit cards. From the business owner’s point of view, using ACH payments can eliminate the backend support needed for printing paper checks and mailing them. While that might not seem like a big deal for a small business, paper paychecks are costly, ranging from $4 to $20 per check. A business with just ten employees issuing bi-weekly paychecks could be spending over $1,000 a month on paychecks alone.

What Are the Advantages of Using ACH?

1. Get Paid Faster

ACH payments are initiated by the payee (your business). This is different than most processes that put an onus on the payor to initiate the payment. This means no more waiting for your customer to pay!

2. Save Money on Payment Processing Fees

Although ACH pricing is determined by your processor, most ACH payments are priced based on a flat rate fee per transaction. The math is pretty simple, if you have a $1 or $1000 payment, the ACH flat-rate fee will be the same. Alternatively, credit card processors charge a percentage based on the payment amount and can start to get very expensive when the transaction amount exceeds $50.

| Transaction amount | Typical ACH processing fee | Typical credit card processing fee* |

|---|---|---|

| $100 | $0.50 | $2.90 |

| $500 | $0.50 | $14.50 |

| $1000 | $0.50 | $29.00 |

| $5000 | $0.50 | $145.00 |

*based on 2.9%

3. Improve Customer Retention

ACH debits increase retention and reduce churn. Credit cards eventually expire, and customers may also lose them, or they may be stolen. This leads to what is known as involuntary churn, necessitating follow-up work to retain payments and customers. By contrast, ACH payments use a bank account number and routing number (also called an ABA). Since bank account numbers are permanent and don’t expire, payments will recur until the customer either cancels the payment or closes the account.

4. Enjoy Business Efficiency

The goal for any business owner is to create the most efficient processes. ACH is a great option to streamline your payment process. Because all ACH debits are electronic, reconciling payments to your accounting records and eliminating manual check deposits go a long way to saving you time so you can focus on the core of your business.

See the comparison of ACH payments vs credit cards

See the comparison of ACH payments vs checks

What Are the Drawbacks of Using ACH?

Like anything, there are drawbacks to ACH payments. Customers may be reluctant to share their bank account information. Some customers also assume that credit card information is easier to access since most people no longer carry paper checks where they could find their account information. Online banking has presented an easy way around this issue, as payors can easily find bank information on their phone or computer. You might consider reminding customers of how to find the required account numbers.

ACH payments are not instant and are revocable. Although there are great reasons for this, it may add some additional complexities to your payment process. With that said, the reason they are revocable is to provide assurance to the payee that there is recourse if an unauthorized ACH debit has been processed on their bank account.

The Best Use Cases for Accepting ACH

ACH payments are best suited for businesses that accept recurring or ongoing payments from their customers. Because ACH payments do not get processed in real-time or clear instantly, using ACH for point of sale or e-commerce is not possible. However, if you have an ongoing relationship with your customer and invoice them regularly, it is a perfect fit.

| Industry | Type of fees |

|---|---|

| Landlord | Rent |

| Daycare | Daycare fees |

| Fitness center | Membership fees |

| Accountant/ bookkeeper | Fees based on hourly rates |

| Internet service provider | Fees based on services used |

| Marketing agency | Fees based on hourly rates |

| Not-for-profit organization | Donations |

ACH vs Wire

Wire transfers are similar to ACH payments, with a few key differences. Wire payments are transferred in real-time, which means delivery within a few hours or even a few minutes. However, this speed does come with a price, as the average wire transfer within the US costs the sender $25. There may be additional fees paid by the receiver to access their money once it hits their bank. However, companies like Western Union do not charge the receiver any fees, nor do they require a bank account—just a valid photo ID. International wire transfers will have even higher fees because of the currency exchange. In any case, wire transfers are good for time-sensitive emergencies, but their high cost makes them poor business options for recurring payments or even one-time payments that are not time-sensitive.

In-depth comparison of ACH vs wire payments

How to Start Using ACH

Given all the wonderful benefits of ACH payments, you might be wondering how exactly you can accept or send them. Your first step is to find an ACH processor that has a connection to the ACH network. Usually, a business has two options here: their bank or a third-party payment processor.

If you want to accept ACH debits or issue ACH credits, you will need to create a merchant account with your bank or a third-party payment processor that offers ACH as a service. If you just want to receive ACH credits (if you are an employee let’s say), a merchant account is not required.

What Are the Differences Between a Bank or Third-Party Processor?

The biggest difference between processing ACH payments through your bank vs a third-party processor is the quality of the user experience. Fundamentally, they both do the same thing. They provide a gateway to the ACH network so you can send and receive money electronically. Banks work off of legacy operating systems which makes it very difficult to change and improve quickly and usually results in a poor user experience. Alternatively, third-party processors are often on the cutting edge of available technology and are intentionally focused on providing the best user experience possible. A better experience might also come with a higher fee.

Third-party payment processors are often better equipped to integrate with the business tools you already use such as your accounting platform. Many small to midsize businesses use a local or regional bank, but these institutions may not have developed an integration that seamlessly plugs into your accounting system. Third-party payment processors may also have additional tools built into their software that assist you with clearer reporting, user permissions, and tools to help you obtain ACH authorizations online within a secure framework.

How Much Do ACH Payments Cost?

Typically, an ACH payment costs between ¢20 and $2. With that said, every bank and third-party processor has their own pricing model. You must also take into account the volume of transactions you are processing each month. The more you process, the better ACH rates get. If you are looking around for a processor, it’s best to ask them to explain all of their fees to be sure you are getting the full picture. It’s also important to review their terms of service which should outline their pricing. Here are the most common types of charges you can expect.

| Cost | ACH Service |

|---|---|

| 0-$150 | One time account setup fee |

| 0-$50 | Monthly service fee |

| 0-$15 | Batch fee (For some ACH processors that require you to batch your transactions and submit them in bulk) |

| $0.20-$2 | Fees per transaction (Note: some third-party processors charge up to 1% based on the transaction amount which can make the cost much higher) |

| $2-$45 | Declined payments and/or chargebacks such as NSF returns |

By contrast, Visa and Mastercard credit card processing fees can range from 1.43% to 2.9% per transaction. American express processing ranges from 2.5% to 3.5%. The price of credit cards is different based on how you accept them. Cards that are present (in person) will have the lowest rates and online credit card payments will have the highest. This is simply due to the risk profile the credit card companies have to manage to mitigate their fraud losses.

How Long Do ACH Payments Take to Process?

ACH payments work off of a batch system, meaning the banks exchange groupings of payments on the network three times a day. Because of this framework, ACH payments are not instantaneous (like credit cards) and require businesses to schedule payments in advance. This also means that settlement takes between 1-4 business days to receive the ACH funds in your account. This gives enough time for banks to communicate with each other and processors to report the payment’s status of approved or declined.

Keep in mind that you may not receive your credit card settlements in real-time either. A credit card payment may take as many as 72 hours to settle, especially since multiple parties are involved: the customer’s bank, the bank issuing their card (if different), the credit card processing network, your payment processor, and finally, your own merchant bank.

You might be wondering: do ACH payments process on weekends and holidays? No, they do not. Remember that the ACH network is operated by NACHA, and although NACHA itself is a nonprofit organization, it works closely with organizations such as banks, the Federal Reserve, and the US Treasury, which are closed on weekends and on federal holidays. As such, the ACH network only operates on business days. Incidentally, this is why many employers have direct deposits issued on a Thursday so that employees can securely have their funds in hand by the weekend.

How Do ACH Debits Work?

As a business owner, you are always looking at ways to become more efficient within your operation and save money where you can. Offering ACH debits as a payment option can accomplish both. The process of accepting ACH debits is very simple.

Once your account is set up with a processor, accepting ACH debits comes down to two actionable steps:

- Collect authorization

- Schedule payments

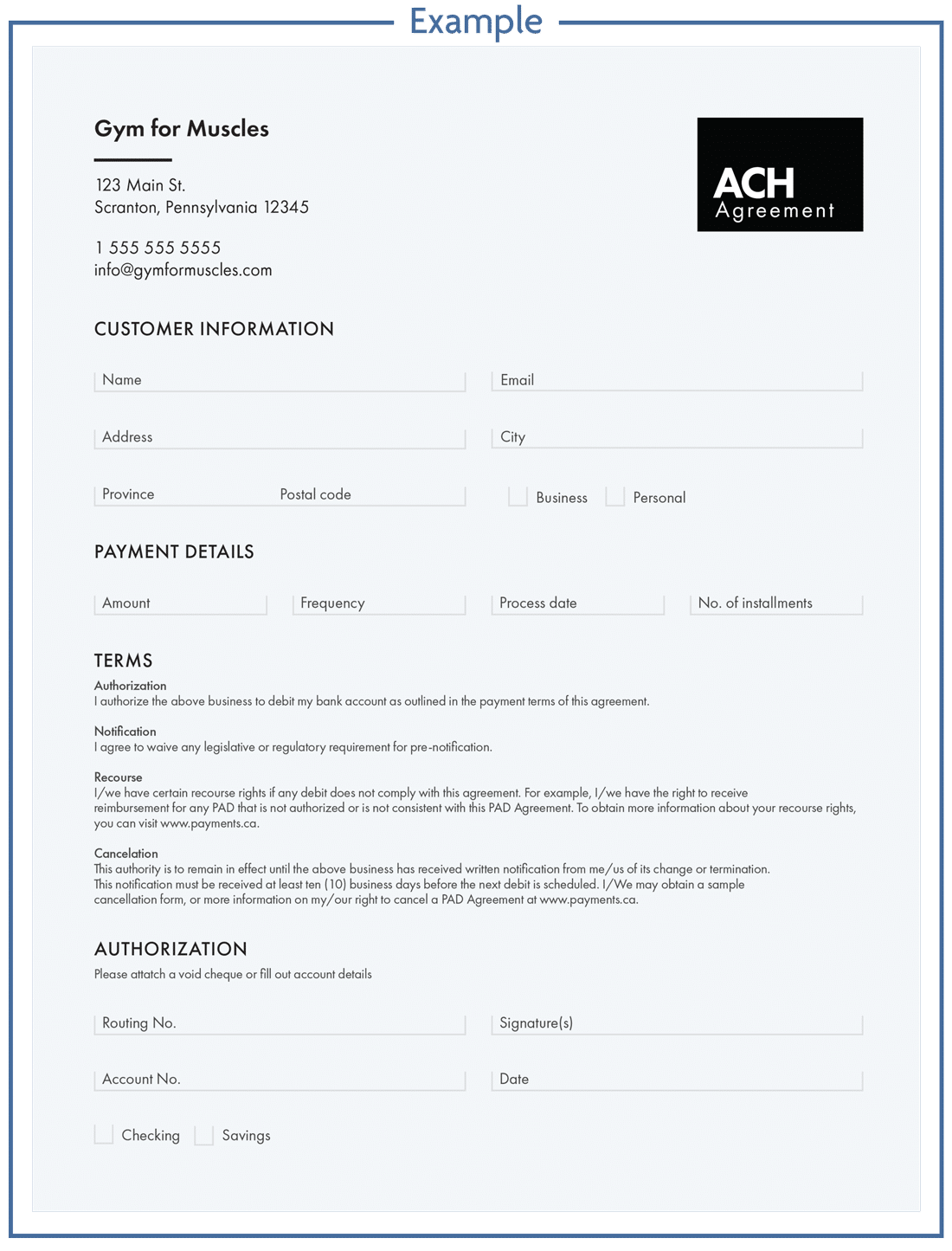

Collecting ACH Authorizations

Understandably, you can not simply take money out of your customer’s bank account without their permission. As outlined in the ACH rules set out by NACHA, you are required to outline the terms of the payment agreement. This is referred to as an ACH Authorization.

Free ACH Authorization Form Generator

Create and download your own ACH authorization form with our new generator tool.

![]()

Requirements of an ACH Authorization

If you want to use ACH debits as a payment method, it’s important you understand your responsibilities and authorization requirements. There are three key concepts to remember:

- Authorizations must be readily identifiable as an ACH authorization

- They must have clear terms so both parties are on the same page

- Payors need to understand their rights to revoke their authorization

Let’s dive into the details of an ACH authorization.

The following is a list of mandatory requirements of an ACH authorization.

- The payor’s account and routing numbers (so you know where to pull the funds from)

- If the payor’s account is a checking or savings account

- A clear outline of the payment amount, frequency, and dates (or indication if it’s an open authorization)

- Signature of the payor or similar identity authentication if the authorization is received online or over the phone

- Date of the agreement

- Contact information so the payor can reach your business

- Explanation of how to revoke the authorization

There you have it, a simple form to outline the ACH payment agreement so you can debit money directly from your customer’s bank account when they owe you money. If you plan to create an online authorization, you are required to verify the bank account through industry-acceptable means like a micro deposit or through a third-party authentication service such as Plaid or Flinks.

ACH Notification Requirements

Like we discussed earlier, the entire point of an ACH authorization is to ensure both parties are on the same page. Informing your customer of any changes to the payment schedule is very important and reflects a spirit of transparency.

If you have set out a specific payment schedule and timing of the payments in your ACH authorization, you do not need to remind your customers each time a payment is coming out of their bank account. With that said, proactive communication about payments is never a bad thing.

If your agreement is based on an open authorization that involves variable amounts and sporadic timing, NACHA requires that you provide payment details to your customer 10 days prior to the process date. If a 10-day notification timeline is not possible you must outline this in the notification section of your original ACH authorization agreement. For example: “I agree to waive any legislative or regulatory requirement for pre-notification.”

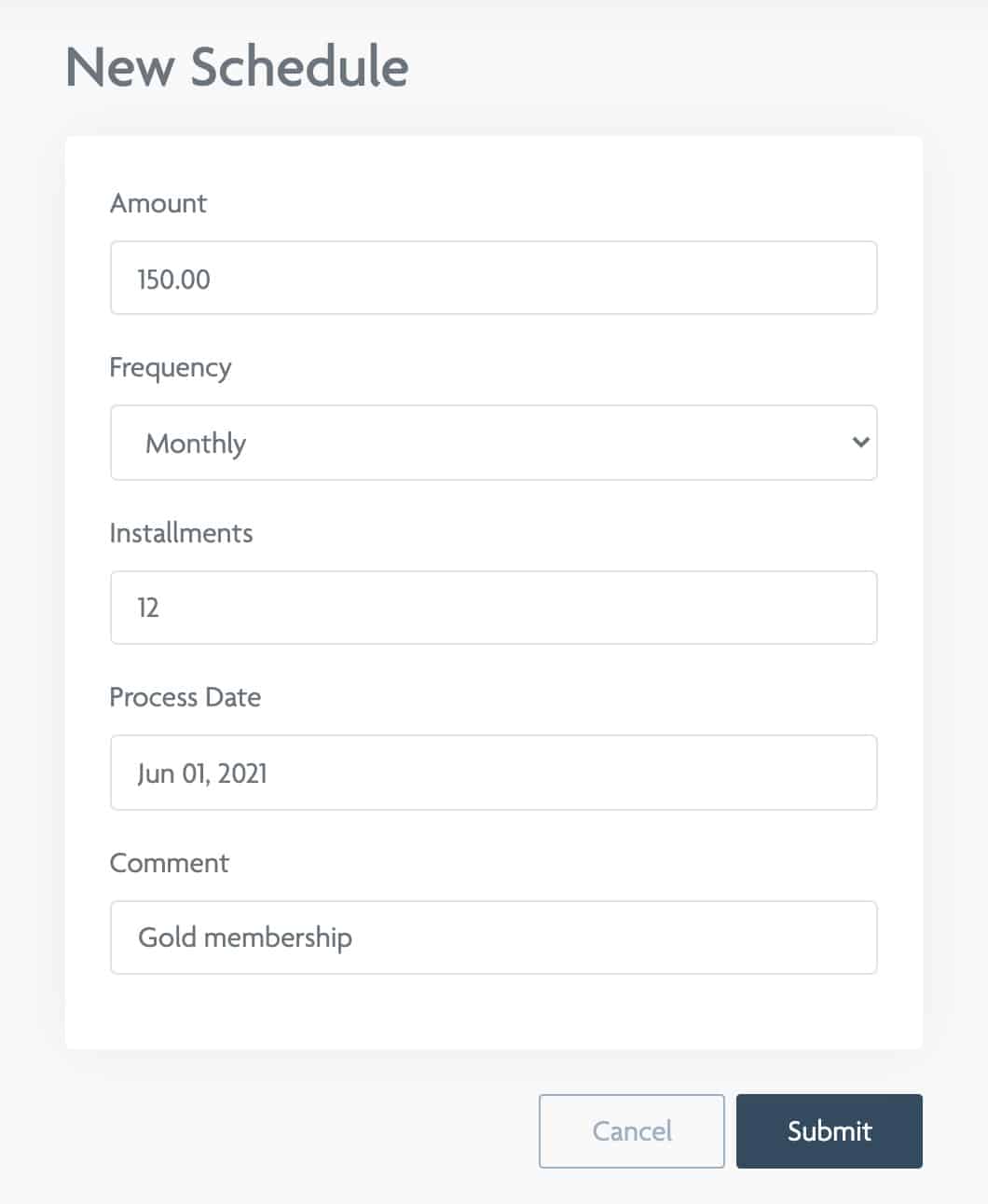

ACH Payment Schedules

Now that you have your customer’s permission and account details, it’s time to create a payment schedule.

Creating a payment schedule simply means defining the timeline for the processing of an ACH payment. This can be done with the software provided to you by your bank or third-party payment processor.

Because ACH payments work off a batch process, you will need to create the payment schedule a minimum of 1-2 business days prior to the process date. So if you are wanting the payments to come out on the 1st of each month, it’s important to submit your payments for processing on the 30th or 31st.

ACH Returns

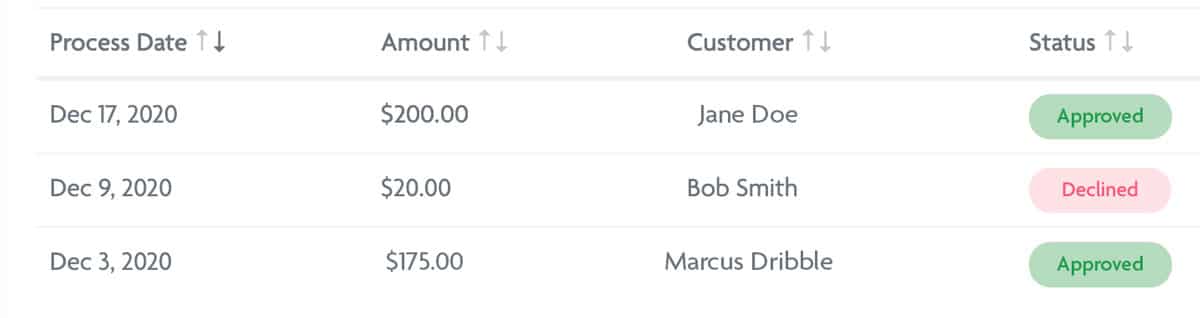

Unfortunately, not all payments you process will be approved so it’s important to keep an eye on your reports provided by your bank or third-party payment processor. They typically will provide you with status reports as payments are processed. On average, you will see notification of a declined payment 2 business days after the process date. When you get notice of a declined payment, you can then take the necessary steps to resubmit your payment.

Unfortunately, not all payments you process will be approved so it’s important to keep an eye on your reports provided by your bank or third-party payment processor. They typically will provide you with status reports as payments are processed. On average, you will see notification of a declined payment 2 business days after the process date. When you get notice of a declined payment, you can then take the necessary steps to resubmit your payment.

Accept ACH payments

Withdraw money directly from your customer’s bank account when their payments are due. Schedule one-time or recurring payments to get paid on time.