In this article, we’ll be looking into the best accounting software for small businesses in Canada. Choosing the right accounting software is an important decision. The right choice will help you focus on running your business instead of spending valuable time doing “the books”.

In this guide you’ll learn:

Best for growing small businesses looking for a scalable solution with flexibility in terms of features and pricing options.

All business owners, regardless of industry, service, or product, need an accounting system that gauges the health of their business, measures success, and guides decision-making.

If you are a newly launched company, with all your receipts in a drawer this guide is for you! This guide is also for you if you are an established business and looking for efficiencies. We’ll evaluate the various accounting software available for Canadian small businesses to help you choose the best option for your bookkeeping needs.

What to consider when evaluating small business accounting software (in Canada)

What Are You Currently Using?

Paper-Based

If your current accounting system is paper-based, this is your opportunity to make an informed decision about digitizing your books. You have a clean slate. There is a bookkeeping software that can fit your business.

Spreadsheets

Still using a spreadsheet in Microsoft Excel, Google Sheets or Apple Numbers? You are not alone. A 2021 article in the Financial Post states that “63 percent of companies consider Excel a vital accounting tool”.

The low or no fees of spreadsheets (often packaged free with a computer’s operating system) make them an attractive option for small businesses.

However, while a spreadsheet might work well for you now, it’s a very manual and limited tool that does not scale well. Spreadsheets can’t integrate payments, invoicing, payroll, receipt storage and so on. If you’re depending on spreadsheets, chances are you’re using other tools to fill those accounting needs. The dynamic features available in accounting software can save a lot of time and hassle as you grow your business.

The better solution

If you are already using accounting software for your small business, this guide will either confirm you’ve made the right choice or that a different accounting software is a better option.

Who’s Doing the Books – Now and In the Future?

Regardless of what you currently use, it’s important to think about your current accounting needs and your future plans. If you’re the owner, will you always have the time to be hands-on with the books? You may reach a point in your business where you’ll need to delegate some or part of the work to someone else. If you plan to share the responsibility, consider accounting software that allows for collaborative work with multiple users. Collaboration allows multiple users to share and manage files and documents as well as work together on projects and tasks from any location, using any device.

Type of Business

The type of business you run can influence your accounting software decision. Although most accounting software can be adapted to most businesses, there are considerations if you run a service-based business or a product-based business.

Do you need to track your time to bill hourly or for attribution to projects? Do you have inventory, such as parts or consumable items that need to be tracked? Both of these scenarios require specific features from your accounting software.

Finally, whether or not you have employees, and how many, can also influence which financial software you choose. A business that employs two people will be less concerned with a payroll function, than a small business that employs a dozen or more people.

Tax Time

Tax season is certainly one of the more stressful times of the year, but good accounting software can help make tax return preparation easier. Accounting software recognizes the type of information that goes into tax forms and, in some instances, auto-fills the required information for you. If you struggle with your tax records, accounting software that helps you complete your taxes and automates tax reporting may be a valuable investment.

Two Types of Software: Desktop or Cloud Based Accounting

Small business accounting software is available in two ways: desktop or cloud-based. Both have pros and cons based on your small business accounting needs, and can even influence when and where you can work on your books.

Desktop accounting software quick overview

Pros:

- One time purchase

- Doesn’t require an internet connection

Cons:

- Initial purchase cost can be significant

- Limited to one device (or number of licenses purchased at additional cost)

- Requires some type of physical backup system

- No automatic software updates

- No real-time collaboration

- Usually no integrations with other software

- Not mobile, unless on a laptop

Cost: one-time purchase with costs for updates and new versions

Cloud accounting software quick overview

Pros:

- Lower upfront costs, with monthly fees usually an option

- Accessible on multiple devices, anytime, anywhere (with internet)

- Automatic, usually free updates

- Automatically stores and backs up data in the cloud

- Often an option to only pay for the services/features you want

- Allows integration and collaboration with other software

- Security up-to-date protocols with features such as two-factor authentication

- Paperless system

Cons:

- Internet dependent

- Security is more dependent on the practices of the people using it

- Ongoing costs, part of business overhead

Cost: subscription-based on monthly or annual basis

Desktop Accounting Software

Desktop software is available for purchase on a physical CD, USB, or, most commonly these days, from an online download. This type of software can only be accessed on the device that it is installed on. Some desktop software may be installed on additional computers based on the licensing agreement. Users should read the agreement prior to purchase

Desktop Software for Your Device

When choosing desktop software, confirm that it is compatible with your computer’s operating system (OS). Does the software work with Windows OS, Mac OS or both? Also, if you want access to your software at any time, consider the limitations of installing it on a computer that’s set up for a specific location. If you want to access and work on the books while at the cottage, then your laptop may be a better option for installation than an office-bound desktop computer.

Cost of Desktop Software

It’s important to consider the following when estimating the true cost to maintain desktop software over time:

- What if you need to purchase licenses for more devices in the future?

- How often are updates or new versions released? What will these updates cost?

- What type of support is offered? Will support be an additional cost?

Also, although a one-time cost may sound appealing, you might end up paying for more than you need. Often, desktop software isn’t offered in value-based tiers with variable features and prices, as is the case with most cloud-based software. With desktop software, it’s usually all or nothing.

Security of Desktop Software

Security, in terms of privacy and data storage, is also important to consider with desktop software. Safeguards should be put in place for access, including a computer password, but where and how your data is stored also needs to be decided. Will you use an external hard drive? If so, where will you keep it? And how often will you back up your accounting data? You should also have a safe place to store the software’s installation CDs or USB if you bought your software in this format. You may need to reinstall your software so you should keep the installation files in a safe and accessible place.

Desktop Software integration

Finally, desktop software programs are also limited in terms of collaboration and integration with other software. These abilities are explained in the next section about cloud accounting.

Cloud Accounting Software

Cloud accounting software is purchased online, accessed using the internet, and all data is stored in the cloud – hence “cloud” software. This software is a subscription service with a monthly fee. Recurring monthly fees keep payment amounts manageable. Software providers may also offer an annual plan. A price discount may be available if an annual plan is paid for upfront.

Devices for cloud accounting software

Unlike desktop accounting software, there is no need to choose a single device for the software, since cloud software is accessed by the internet, not a downloaded file. Most cloud accounting software can be accessed on multiple devices usually through a web browser. This includes mobile phones and tablets, as long as the device has access to the internet. So if you travel a lot or have multiple locations, this type of software might be a great option for you.

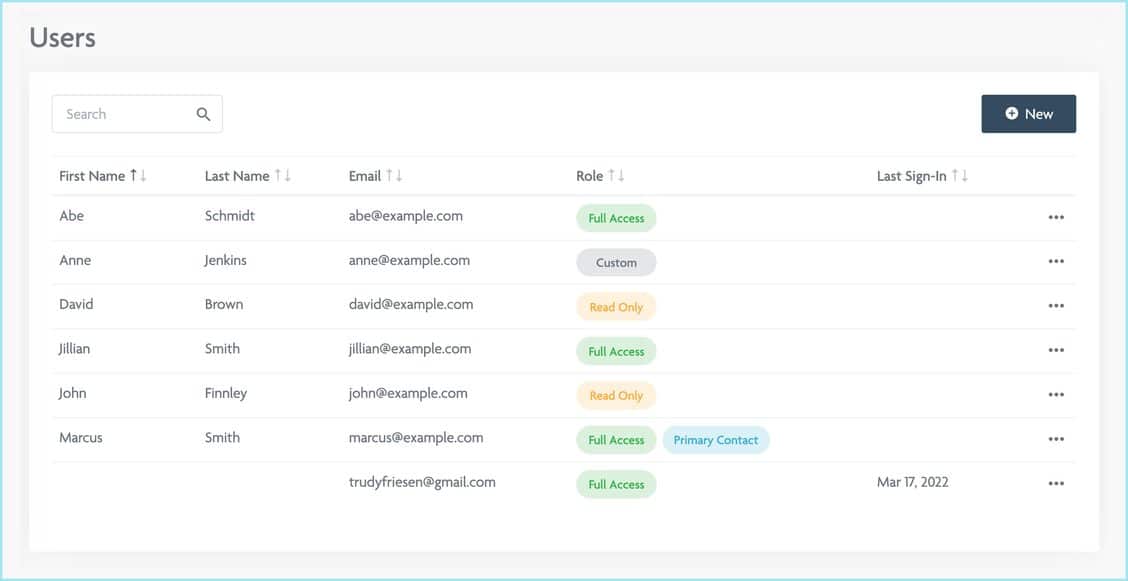

Multiple users for cloud accounting software

Cloud accounting software often allows you to have multiple users, with individual logins and different roles. With some cloud accounting software, the type of roles and number of users allowed might come at an additional cost. User roles and permissions are a nice feature of cloud accounting software that allows you to limit certain functions or viewable information in the software based on a participant’s role in your company. This feature also makes it easy to transfer a role or delete a user if, for example, you have an employee leave your company.

Cloud accounting software and security

Data protection and security are integral to cloud accounting software. All data stored in the cloud is encrypted. This means the information is converted into an unreadable format before it is transferred and stored in the cloud. The encryption process is then reversed when the information is required and accessed from the cloud.

Most cloud accounting software also offers two-factor authentication, the process where two methods of identification are required to gain access to your account. It’s important to note that good security relies on the diligence of the people using the software. Educating your staff on good passwords and other security practices is critical.

Storage with cloud accounting software

Most cloud accounting software offers a standard amount of storage for your accounting data included in your regular subscription price. Additional storage is sometimes also available at an additional cost. Fortunately, accounting data is usually not very storage hungry and won’t require large amounts of storage. However, storage becomes a greater consideration if you’ll have a lot of external accounting files that will need to be uploaded and saved in your account. How long will you need to save and access your accounting records? For tax and legal purposes, some businesses are required to keep records for several years.

Updates for cloud software

A great benefit of cloud software over desktop software is updates that are nearly always free for cloud accounting software. With cloud software, you will always be working with the latest version and won’t have to worry about the effort or cost to keep your software updated.

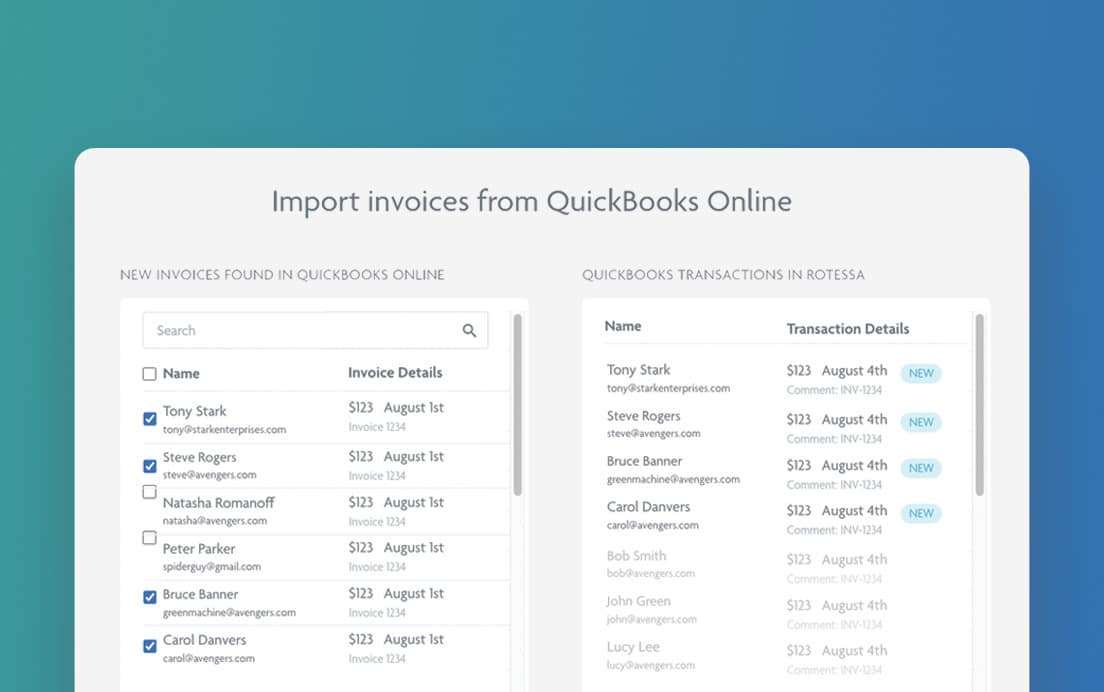

Cloud software integrations

Lastly, cloud accounting software provides the opportunity to collaborate or integrate with other cloud software. For instance, if you use a payment processor, such as Rotessa, to collect payments from your customers, this information can be automatically integrated with your accounting software to mark invoices paid and streamline your entire collection process. This can provide significant efficiencies, saving you valuable time.

We have a cloud accounting series for you to learn more about cloud technology.

Choosing the right software for your small business

Now that you understand the difference between desktop and cloud accounting software, do you know which one is best for you? If your answer is yes, then congratulations! You’ve now made the first step towards choosing the best accounting software for the needs of your small business. If you said no, that’s ok too. We will review individual accounting software offerings next which will also help you to decide.

It’s important to note that users of desktop accounting software are on the decline. It doesn’t mean it’s not right for your business, but cloud accounting software adoption is on the rise, rapidly. For this reason, when we look at individual software we will focus on cloud accounting software options and provide the pros and cons of each.

Popular accounting software for small businesses in Canada

- Quickbooks Online

- Xero

- FreshBooks

- Sage Accounting

- Wave Accounting

- Zoho Books

Let’s take a look at each one…

Note: Prices identified do not include promotions that are often available. It’s highly advisable to check for any promotions or free trials that may be offered, especially for first-time users.

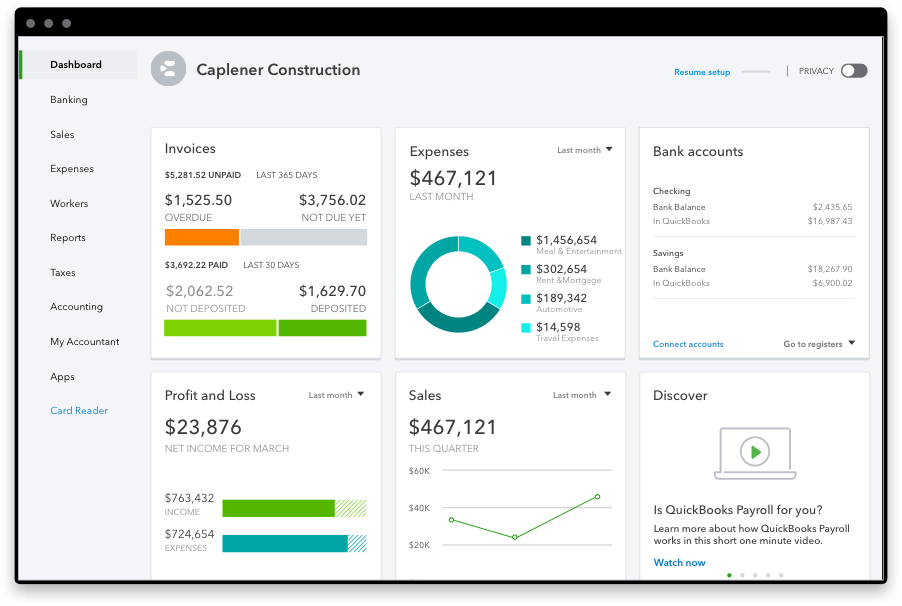

QuickBooks

QuickBooks, founded in 1983, is a highly recognized name in the accounting world, owned by parent company, Intuit. Headquartered in California, It’s known for its intuitive interface and reporting capabilities. QuickBooks – both Online and Desktop – will work for most businesses and, in many ways, is considered the gold standard of accounting software. However, This all-in-one solution may have you paying for more than your business needs.

Pros:

- Centralized dashboard

- Expense tracking

- Report customization

- Multiple users

- Payment approval automation

- Payment reminders

- 24/7 support

- Online training

- Invoicing (including invoice batching)

- Inventory tracking

- Mobile app that provides access to some features using a tablet or smartphone

Cons:

- Lack of industry-specific features

- May be a steep learning curve due to wide range of functionalities

- File size limits for uploads

- Limitations on the number of transactions

- Slow loading during peak times

Payment Processing: Electronic Funds Transfer (EFT), Credit Cards

Payroll Function: Yes, available with all QuickBooks Online plans

Best for: Established businesses looking for full-featured accounting software.

Available Formats: Desktop (QuickBooks Desktop) and cloud (QuickBooks Online)

Cost:

Quickbooks Desktop – Pro Plus $549, Premier Plus – $799

Quickbooks Online – $22-$140 per month, depending on 4 plan options (EasyStart, Essentials, Plus, Advanced)

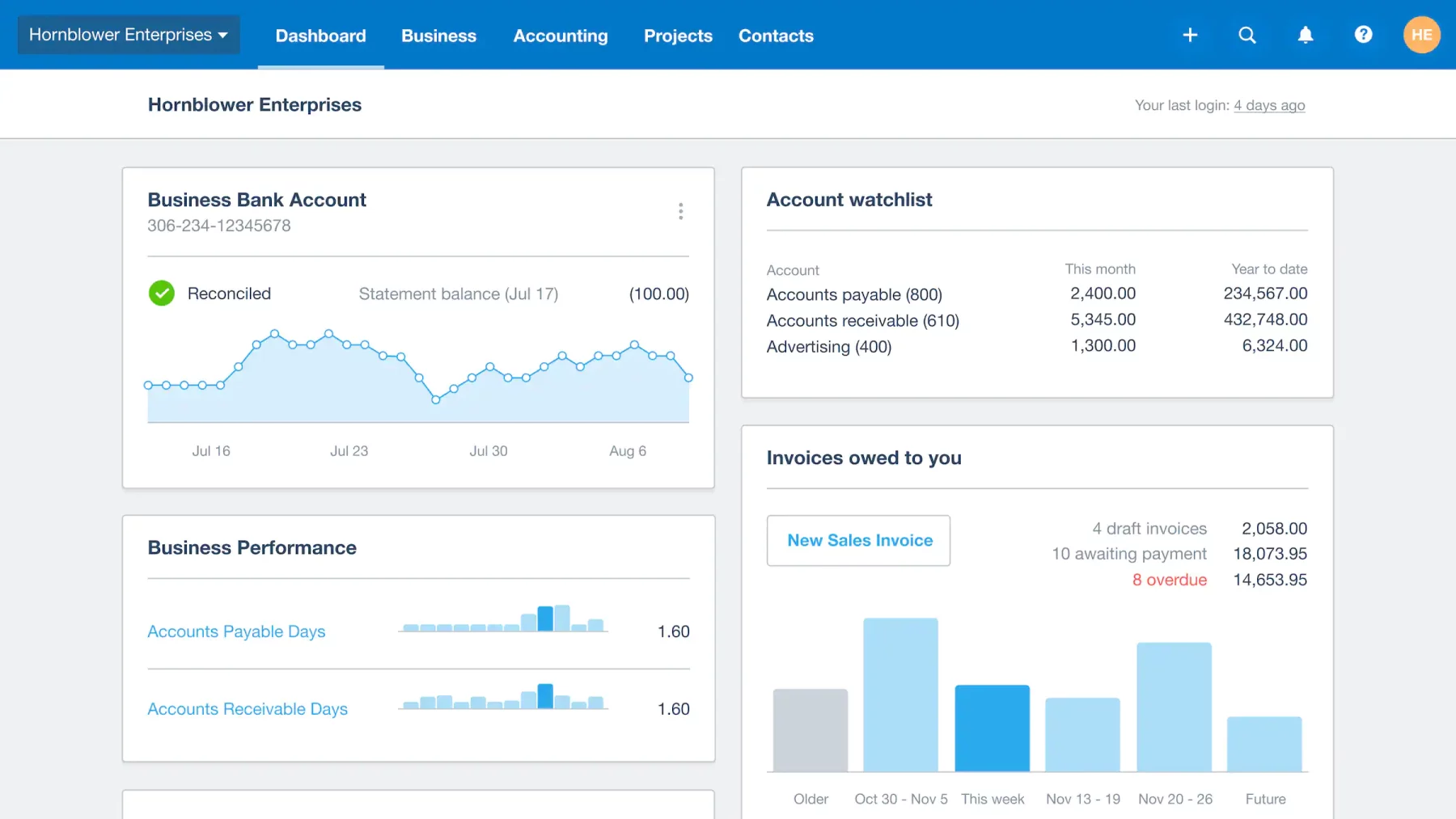

Xero Accounting

Originally called “Accounting 2.0” Xero was founded in 2006 in New Zealand. It was first launched in Canada in 2018 and has been gaining popularity ever since. They’re known for their user-friendly interface and tagline “beautiful business” which reinforces the idea that their software isn’t just necessary, but also enjoyable to use.

Pros:

- User-friendly interface

- Payroll management

- Batch payments

- Strong integrations with other cloud software

- Constantly updating application

- Real-time tracking of hours

- Mobile-friendly

Cons:

- Limited reporting options and not customizable

- Limited tracking categories

- No search function

- Invoices aren’t very customizable

Payment Processing: Credit Cards and EFT

Payroll Function: Yes, maximum 4 employees, otherwise they offer integration with payroll software.

Best for: Growing small businesses looking for a scalable solution with flexibility in terms of features and pricing options.

Available Formats: Cloud-based only

Cost: $9-$58 per month, depending on plan (Starter, Standard, Premium)

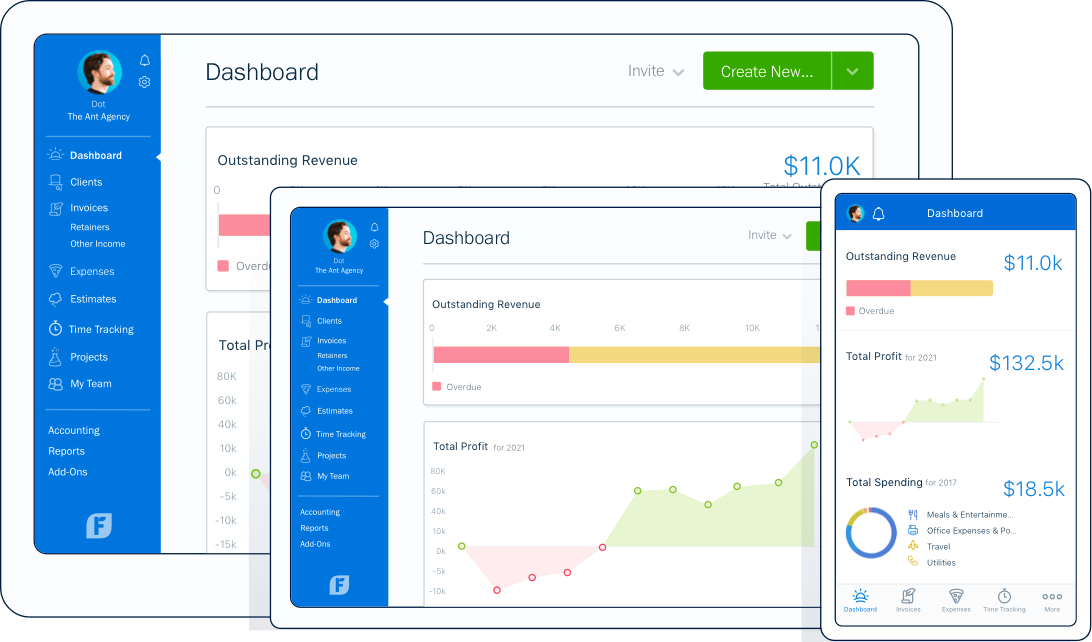

FreshBooks

Founded in 2003, with headquarters in Toronto, FreshBooks was originally created as an online invoicing service for IT professionals. FreshBooks is a common choice for service and project-based companies because of its time and project-tracking tools.

Pros:

- Time tracking

- Project management tools

- Real-time invoice tracking

- Customized invoicing

Cons:

- Minimal accounting features

- Limits on users and billable clients

- Limited access on mobile app

- Lack of reporting features

Payment Processing: Credit cards, EFT

Payroll Function: No built-in processing, but offers integration with payroll platform Gusto

Best for: Service and project-based companies as well as self-employed professionals.

Available Formats: Cloud-based only

Cost: $22 – $60 per month, depending on 3 plan options (Lite, Plus, Premium). A custom pricing option based on requirements is also available.

Sage Accounting

Pros:

- Works with multiple currencies

- Full-featured mobile app

- Integration with third-party apps

- Project tracking

Cons:

- No time-tracking feature

- Limited customization for reports

- Older interface

Founded in 1981 in Newcastle, England, Sage Accounting offers two software package options: Sage One , which offers basic accounting features and is geared towards freelancers and microbusinesses and Sage 50, which offers more advanced features and is more flexible, geared towards small and medium businesses.

Payment Processing: Credit cards, EFT

Payroll Function: Yes, for Sage 50 up to 10 employees are included in all plans. Additional cost based on a tier system (50 employee maximum). For Sage One plans, this is an additional function that starts at $23/mth plus $3 per employee.

Best for: Freelancers and micro-businesses.

Available Formats: Cloud-based only

Cost: Sage One, $17 – $55 per month, depending on 3 plan options (Start, Standard, Plus)

Sage 50, $59.50 – $376.25, depending on 3 plan options (Pro, Premium, Quantum)

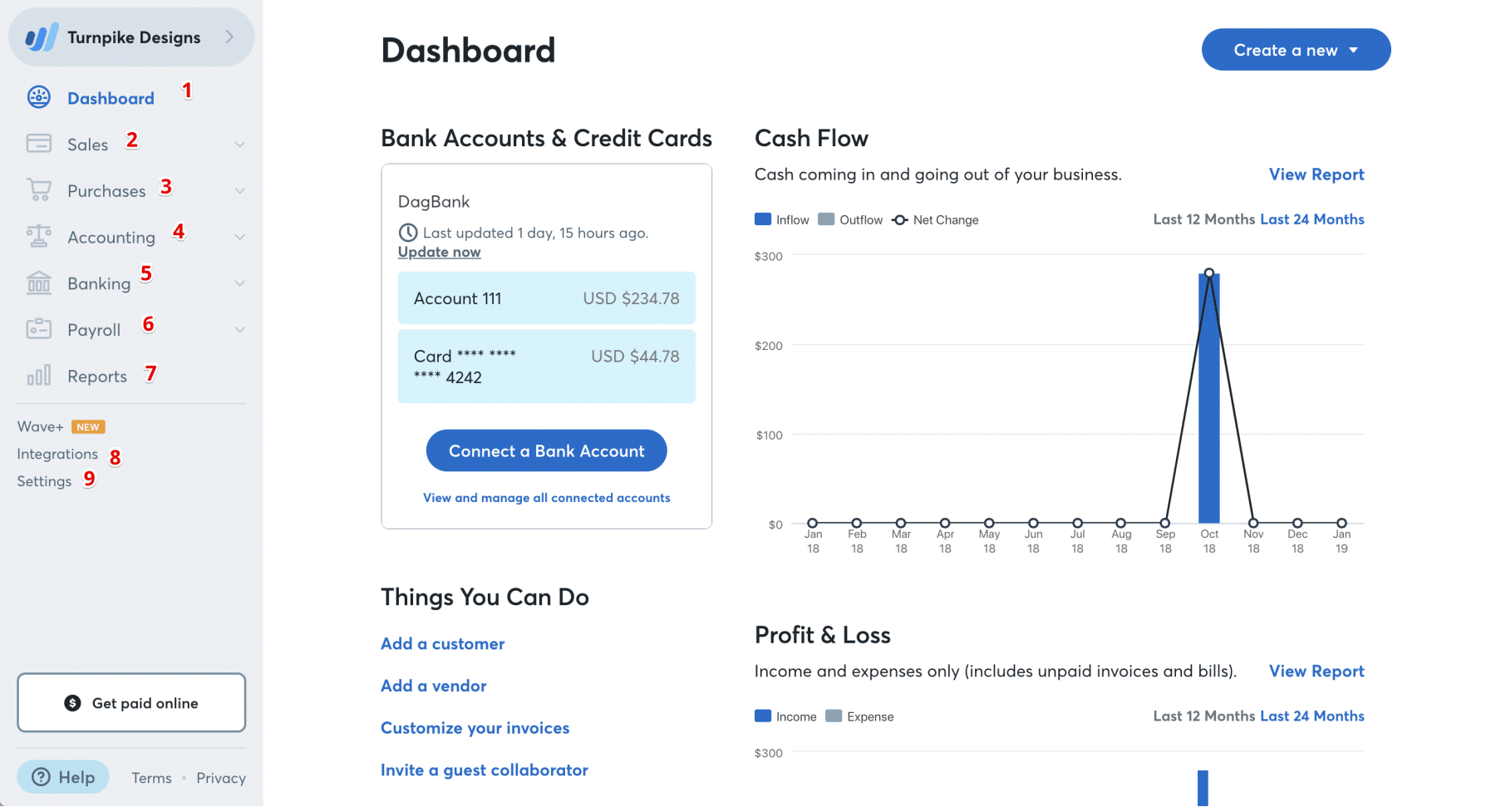

Wave Accounting

Pros:

- Easy to use

- Cost (free)

- Unlimited users

- Unlimited invoices

- Accessible anywhere

- Existing third-party integrations

Cons:

- No plan upgrades with free software, so not scalable

- No new third-party integrations (only those already in place)

- Limited customer support (email only for free services)

- Limited customization for invoices and quotes

- Advertisements are shown in app

This Canadian company was launched in 2009 and is owned by tax-preparation company H&R Block, headquartered in Toronto. H&R Block’s ownership of Wave is important to know as it explains why Wave offers its software free but charges for bookkeeping and coaching services. Wave also offers add-on payroll and online payment processing for a fee.

Payment Processing: Credit cards, EFT

Payroll Function: Yes, at additional cost. See pricing below.

Best for: Service-based companies on a budget and no accounting experience.

Available Formats: Cloud-based only

Cost: Accounting and invoicing software is free.

Credit cards – 2.9% plus $0.60 per transaction, AMEX – 3.4% plus $0.60 per transaction, Bank payments (EFT) – 1% ($1 per transaction minimum).

Payroll software – $25 per month plus $6 per active employee or contractor paid

Bookkeeping support – $149 per month

Accounting & Payroll coaching – $379 one-time fee (other packages available)

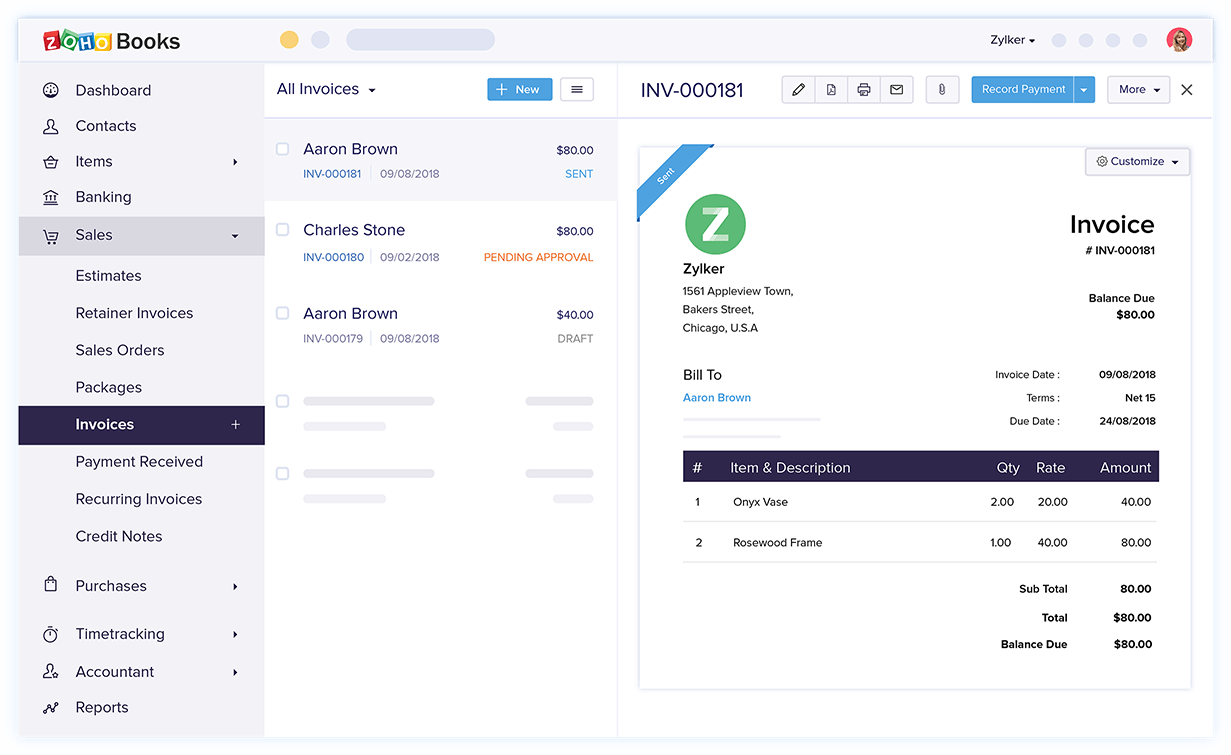

Zoho Books

Pros:

- Simple layout

- Payment reminders

- Mobile friendly

- Great for entry-level

- Good for service-based businesses

Cons:

- Restriction on number of users per plan

- Payroll not included

- Integration options are mostly limited to Zoho suite of services

- Limited invoice customization

Founded in 1996, Zoho Books is one of 50 software programs owned by multinational IT company Zoho Corporation. The company’s global headquarters are in India but in 2022 they opened a Canadian office in Cornwall, Ontario. Zoho Corporation focuses on scalability and lessening the adoption barrier for users by offering dynamic integration of their many business apps.

Payment Processing: Credit cards and EFT through third-party integration

Payroll Function: No, but integration is available with Zoho Payroll app (additional cost)

Best for: Start-ups and small businesses with CRM (client relationship management) needs.

Available Formats: Cloud-based only

Cost: $0 – $290 per month, depending on 6 plan options (Free, Standard, Professional, Premium, Elite, Ultimate)

Conclusion

Choosing the best accounting software for your small business allows you to spend less time bookkeeping and more time running your business. Your accounting software should save you time, track and monitor the health of your business, and assist with decision-making. We have looked at many of the options, but only you can decide what is important to you and your specific business. The final decision will come down to your business’ needs and your budget.

Share this content with a friend:

A better way to get paid

Withdraw money directly from your customer’s bank account when their payments are due. Schedule one-time or recurring payments to get paid on time.